Indexed Universal Life Insurance [IUL], can be a profitable part of a retirement portfolio. Its primary purpose is life insurance, but it can also provide tax-free income with additional benefits that cannot be matched by a portfolio of just stocks, bonds and mutual funds.

As much as Wall Street is trying to convince the investing public that the stock market is the best place to be; it's interesting to note that Top Executives at some 4,000 banks across America own some $140 Billion in Permanent Cash Value Life Insurance. This pays for their own executive pensions and bonuses (source fdic.gov). Furthermore, over 700 [non-bank] US corporations, listed on the Fortune 1000 list, also own Permanent Cash Value Life Insurance to fund the pensions of their Top Executives with tax-free income. A saying comes to mind:

"Don't follow what they say – follow what they do."

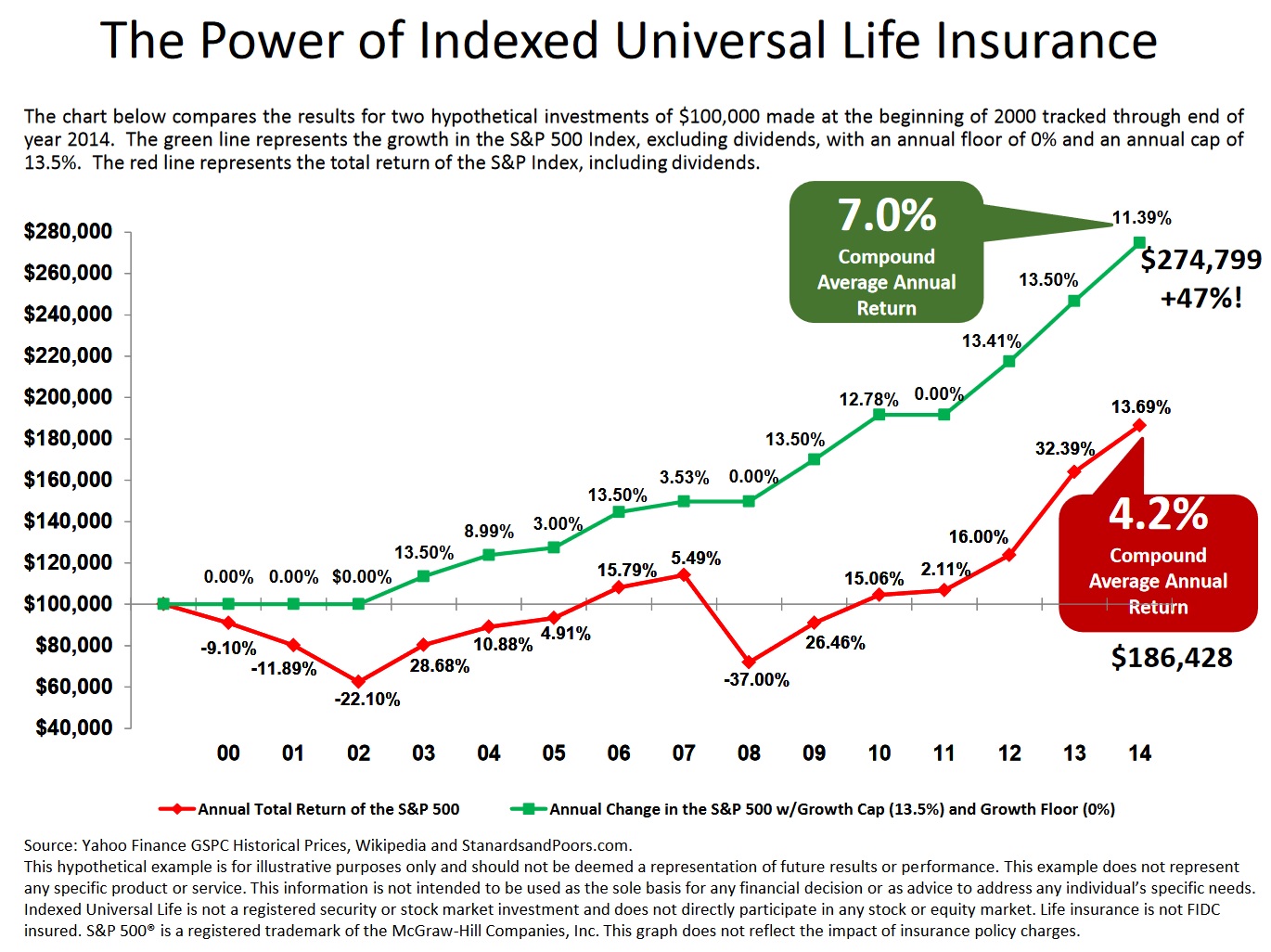

Indexed Universal Life Insurance [IUL] is, in fact, Permanent Cash Value Life Insurance. Just like Fixed Indexed Annuities, IULs are tied to [not invested in] a Stock Market Index (i.e. NASDAQ, NYSE or S&P500). Therefore they're not subject to stock market risk and losses. They can grow by double-digits when markets rally. In order for a properly structured IUL policy to work at its optimum, it needs to be funded to its maximum allowed by the IRS, and the death benefit should be minimized, including the calculation of policy fees and charges. This will allow for maximum Cash Value growth, which can then be turned into tax-free income, or policy loans. This is why Corporate America loves it. This is also why investors should consider an IUL policy, especially younger and mid-career professionals with some 20 years or more until retirement. For them IULs can be a goldmine.

To set up a tax-free income stream in retirement, or at any age, without incurring IRS penalties.

The ability to treat it like a 'personal bank', where loans can be taken out and paid back as you please; for emergency cash, college expenses, car buying, even a house purchase. There's never a loan application and you pay yourself the interest you owe, not some bank.

Access accelerated Living Benefits for Long-Term Care in case of terminal or chronic illness.

This could save IUL policy holders from having to buy expensive Long Term Care policies.

And, of course, IULs are ultimately Life Insurance policies, which pay out tax-free death benefits, often in the hundreds of thousands of dollars. Combine all these features and you get a really nice package of benefits.

There's a reason Executives across America buy Permanent Cash Value Life Insurance.

It's smart leveraged money. We should all be so smart.