Creating guaranteed lifetime income

will support your favorite Charity

Text or Call 949-229-3375 with Any Questions

A retirement plan that includes a Fixed Indexed Annuity (FIA) can cover your Basic Cost of Living with

guaranteed lifetime income. Why do this? Because millions of American families [over]-invest in

excessive stock market risk causing crippling losses and financial hardship in recessions and

market crashes. Regardless of wealth or age, nothing could be more important than financial

security in retirement when working is no longer an option, or desired. FIAs can provide that security. After implementing your

plan, CIS (a nonprofit) will donate up to 75% of its commission to your favorite charity. This is unprecedented.

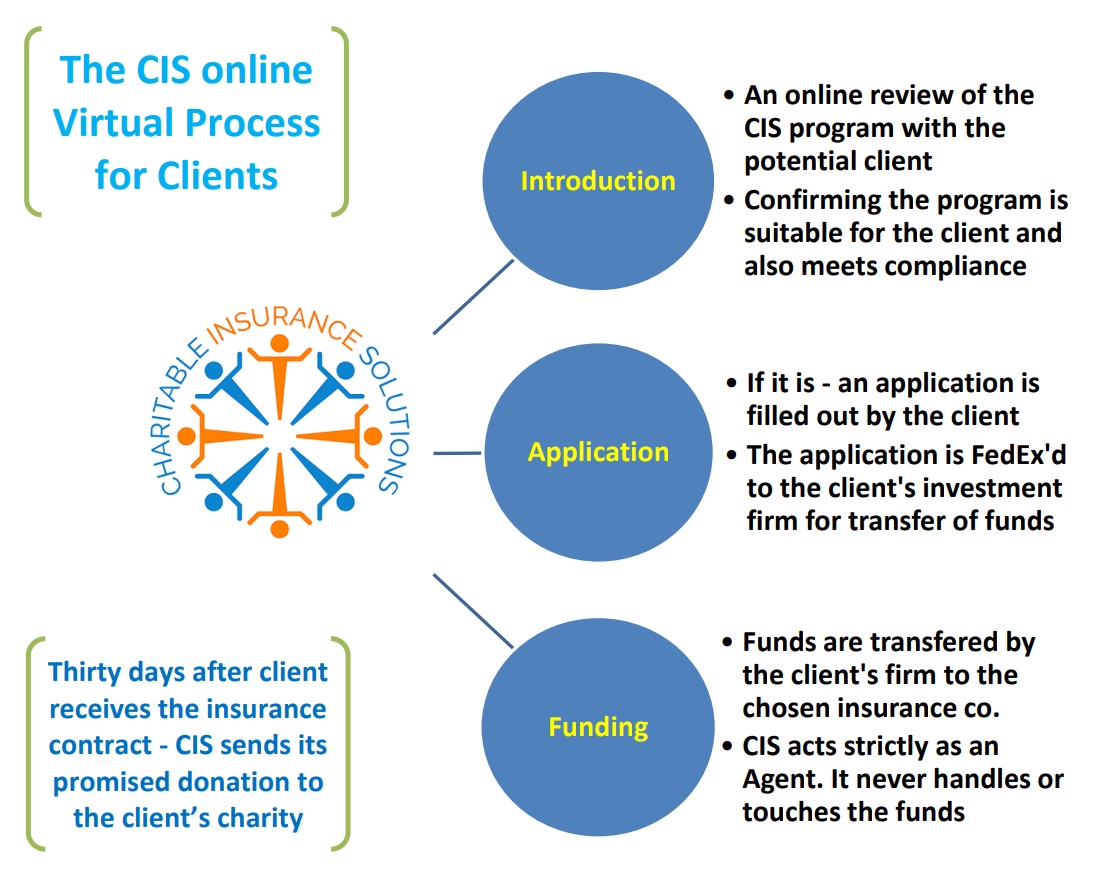

Our Process for Donors

See below the simple process for donors/investors choosing a Fixed Indexed Annuity for retirement income.

The US Dept. of Labor has a short list of questions that will determine the Basic Cost of Living in Retirement. We're using the same list of questions. Please see below. (the information is secure and never sold).

Based on your Annual Grand Total we'll provide you with an illustration of a

guaranteed income stream in retirement. Please note - to run an illustration your net

liquid assets must range from $100,000 to $1 million, or contribute a min. $6,000/year to a

savings plan.

Click on either 'Fully Retired' or 'Near Retirement or Younger' to get

started: